The coronavirus pandemic hits the freight wagon global market which already faced a decline at the end of 2019, even without the effects of the crisis, according to the latest report of SCI Verkehr.

The downturn in worldwide production and transport demand has taken a hold of the industry at an already weaker phase and the national stimulus packages cannot compensate for this everywhere and only partially.

After an all-time high in 2018-2019, a calming of the market already began at the end of 2019 even without the effects of the coronavirus pandemic. The report says that China and Russia are mainly responsible for this situation. While China Railways has relatively clearly failed to meet the targets it has set itself in the form of a procurement plan with up to 210,000 freight wagon between 2018 and 2020, and in Russia, the process of fleet renewal, which has led to extensive procurements in recent years, is largely complete.

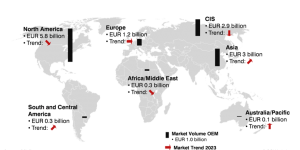

Growth is still expected only for Asia (with a EUR 3 billion freight wagon market) in the time period 2018-2023, which will be achieved mainly by India. China, as one of the most important growth engines of the past, seems to have initiated a rather rare paradigm shift and is procuring at a medium level.

In North America, interim procurement peaks have recently passed, and the market is slowly cooling down. The market on the continent is estimated at EUR 5.8 billion, with a decrease trend.

In the CIS region, the fleet has been extensively modernised in recent years and demand for new rolling stock is diminishing. EUR 2.9 billion is the value of the market during 2018-2023.

In Europe where the freight rolling stock market is estimated at EUR 1.2 billion, the process of market calming also began at the end of 2019, after the temporarily very high demand for various types of wagons had been met. At times, the high demand exceeded supply in some freight wagon segments and led to significant price increases.

According to SCI Verkehr, the prices will recover in the scope of the demand reduction and it is expected an overall rising market volume of approx. EUR 1.2 billion from 2018 until 2023. The expected increase is below the considered and calculated price development. In fact, a slight decline in delivery volumes can be expected in the medium term.

SCI Verkehr says that the economic stimulus packages initiated both Europe-wide and nationally in the context of the coronavirus pandemic the latter especially in Germany and France, as well as the generally increasing influence of climate policy on European governments have a high potential to have a positive effect on rail freight transport and thus on the demand for freight wagons and to cushion the crisis-related decline in demand.

Share on: